|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

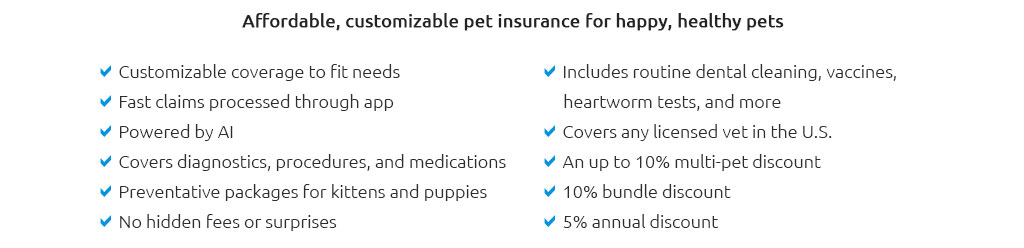

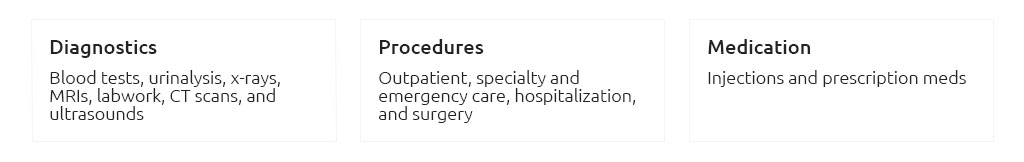

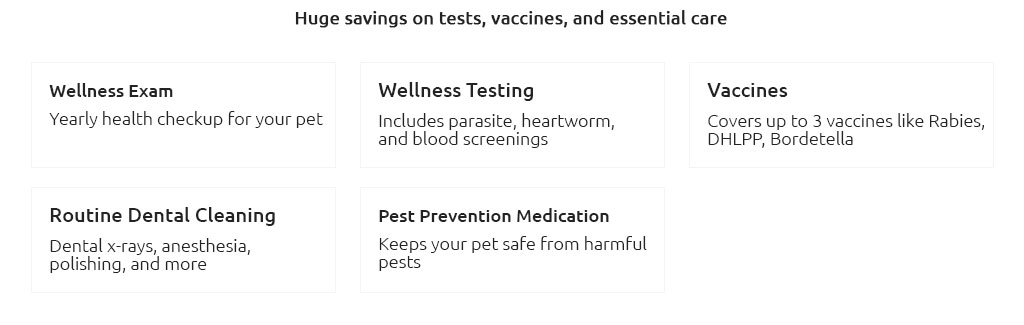

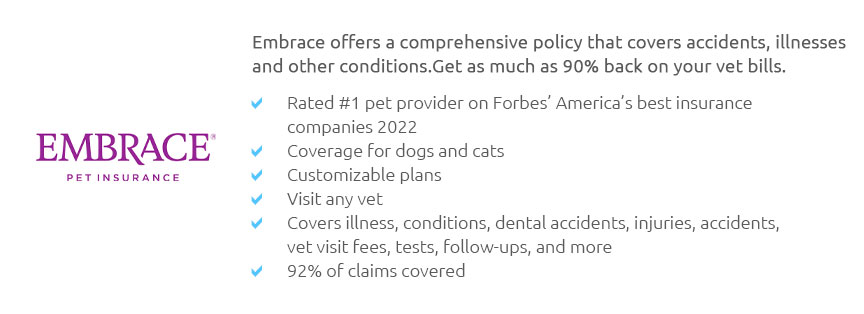

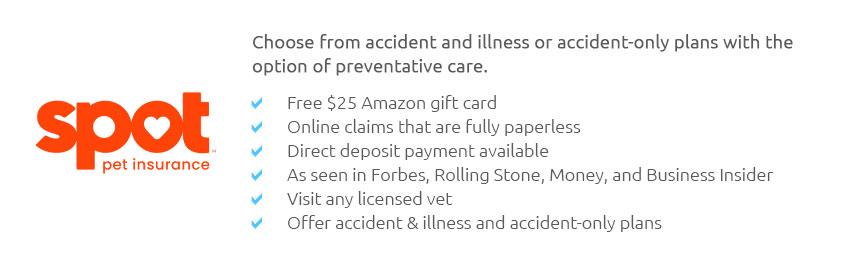

Understanding Pet Coverage: A Comprehensive OverviewIn recent years, the concept of pet coverage has gained considerable traction, evolving from a niche offering to a mainstream consideration for many pet owners. This rise in popularity can be attributed to the growing recognition of pets as integral members of the family, deserving of the same level of care and protection as their human counterparts. At its core, pet coverage is a type of insurance designed to mitigate the financial burden associated with veterinary care, offering peace of mind to pet owners who are increasingly concerned about the rising costs of medical treatments for their beloved animals. One of the key aspects of pet coverage is its ability to provide financial assistance for a wide range of medical services. These can include routine check-ups, vaccinations, and emergency surgeries, as well as coverage for chronic conditions and even alternative therapies such as acupuncture or hydrotherapy. By offering such a broad spectrum of services, pet insurance allows owners to make decisions based on what is best for their pet's health rather than being constrained by cost considerations. As with any insurance product, the specifics of pet coverage can vary significantly between providers, necessitating careful consideration and comparison. Policies may differ in terms of premium costs, deductibles, and reimbursement rates. Some plans might offer comprehensive coverage, while others focus on accident-only scenarios. Therefore, it is crucial for pet owners to thoroughly assess their pet's specific needs and potential risks before selecting a policy. Moreover, the decision to purchase pet coverage often involves weighing the perceived value against the costs. On one hand, premiums represent a regular expense that can add up over time, yet they provide the reassurance that unexpected veterinary bills will not lead to financial strain. On the other hand, some pet owners may opt to self-insure by setting aside savings for potential future expenses. This approach requires discipline and foresight, yet it can be a viable alternative for those who prefer not to engage with traditional insurance models.

In conclusion, pet coverage serves as a valuable tool in the broader landscape of pet care, enabling owners to provide the best possible medical attention to their pets without the looming fear of financial hardship. As the industry continues to expand and evolve, it is anticipated that pet insurance will become an increasingly standard component of responsible pet ownership, reflective of a societal shift towards recognizing the profound impact pets have on our lives. Ultimately, whether one chooses to invest in pet coverage or pursue alternative strategies, the overarching goal remains the same: to ensure the health and happiness of our furry, feathered, or scaled companions. https://www.fetchpet.com/

Fetch Pet Insurance provides the most comprehensive coverage out there. That means we cover what others charge extra for or don't cover at all. Take sick visits ... https://www.pa.gov/agencies/insurance/consumer-help-center/learn-about-insurance/pet-insurance.html

Pet insurance is designed to help offset veterinary costs. Below is some information to help you learn more about pet insurance and shop for the best plan for ... https://www.geico.com/pet-insurance/

Pet insurance can help manage health costs for your pets. Pet insurance is a specialized health insurance for your beloved pets. Get affordable care for your ...

|